do you pay california state taxes if you live in nevada

Therefore unless you have taxable income other than W-2 wage income such as stock sales earned interest dividends rental property income etc you can safely assume that CA will be taxing. Say you move from California to.

Pros And Cons Of Moving To Nevada From California

After we input these variables into our software we press Simulate.

. 4 Only when you live in NV and work in NV does CA not tax your wage job income. Living in any of the other 41 states will mean filing and paying state income taxes. As a resident we have no state income tax if you earn your money in Nevada or if you have passive income even if it comes from California.

Assume there is no Nevada location of the Company. In California S-corporations are taxed at a rate of 15 on the net taxable income with the minimum tax being 800. After all Californias 133 tax on capital gains inspires plenty of tax moves.

For income taxes in all fifty states see the income tax by. It is true that in Nevada you do not pay tax on that income but California can tax you. Californias Franchise Tax Board administers the states income tax program.

If you are a resident of Nevada and are employed in California you will be taxed by California. 3 If you live in CA and work in CA then CA taxes all of your wage job income. When it comes to property tax Nevada and California boast similar rates.

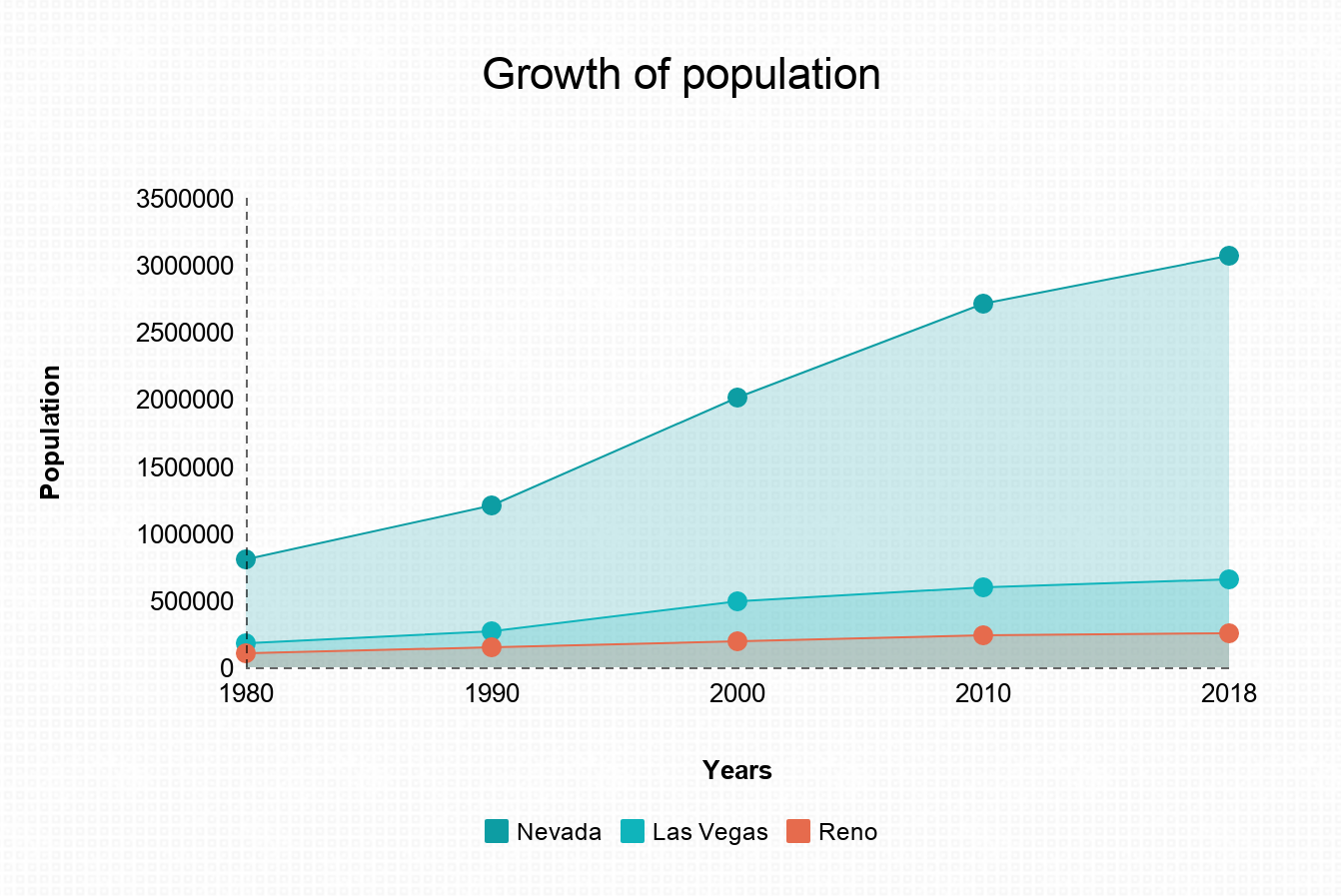

This federal law prohibits any state from taxing pension income of non-residents even if the pension was earned within the state. By simulating a move to Nevada from California we find that Bob and Jane save over 156000 in taxes throughout their retirement. In Nevada there is no income tax imposed.

Does the fact that you lived in California from Jan. Nevada does not have state income tax. This is enough to get them a little over one extra year of income.

These are levied not only in the income of residents but also in the income earned by non-residents who are working in the state. 79 and in Nevada its. This tool compares the tax brackets for single individuals in each state.

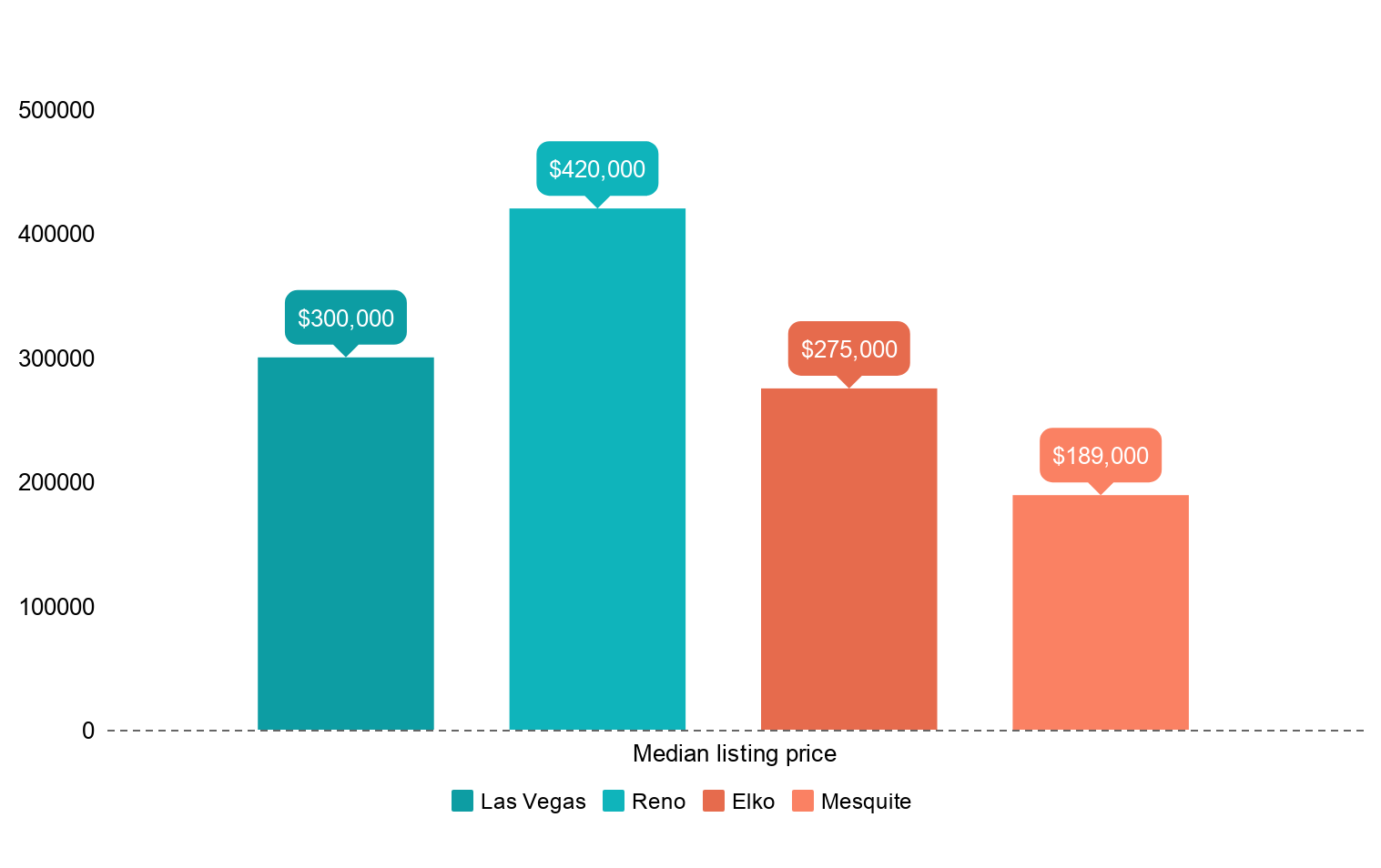

Below is a summary of state tax rates in Nevada compared to California. An extra 1-percent surcharge is also levied onto incomes of more. Even where California agrees that you moved they might not agree when you moved.

Say however you move on June 30 2011. If your state of. You do not have to be in your new state for 183 days just outside the.

Furthermore below you can see a year-by-year breakdown of Bob and Jane. However even though you do not live in California you still must pay tax on income earned in California as a nonresident. Use this tool to compare the state income taxes in Nevada and California or any other pair of states.

California is notorious for having the highest state income tax bracket in the nation with a top marginal income rate tax of 123. 1 to June 30 2011 make all of your 2011 income taxable as if you were a California resident for the entire year. The personal income tax rates in California range from 1 to a high of 123 percent.

In most cases if the state in which you earned your income collects income tax you must file a return. Can the state of California tax me on wages if I lived in Nevada all year. However this rate does not include an additional 1 surcharge for tax payers with incomes over 1 million per year making their top marginal tax.

If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of company do I have to pay California state taxes for 365 days or for just 65 days. Say however you move on June 30 2011. In Nevada there is no income tax imposed on S-corporations.

The highest rate is levied at income levels of at least 526444. As such if you can prove to California state that you are not a resident but rather vacationing there or if the California home is in the name of someone with no income and the Nevada home is in the name of someone with a high income it is possible to live in California for a fair amount of the year without having to pay state income. That means Californians pay substantially more property tax than Nevadians.

If you move to Nevada Texas or one of the other states without an income tax that money goes straight back into your pocket. How long do you have to live in Nevada to be considered a resident. For instance if you live in California and you have 1500000 in taxable income your state income tax bill comes out to approximately 175921.

In California the effective property tax rate is. My experience has shown me that if it is Primary than the tax advantages can be more substantial. If you live in Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas or Washington you wont be taxed.

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. The confusing part is whether or not you will have to pay taxes in the state where your employer is located. In California partnership LLCs pay a tax ranging from 1700 to almost 12000 per year depending on the net taxable income of the entity.

For more information about the income tax in these states visit the Nevada and California income tax pages. The state of California requires residents to pay personal income taxes but Nevada does not. Yes you need to file a non-resident state return for the California income.

State of Employment. If you move from California to Nevada this seems to avoid California state taxes in many instances. You will want to file the non-resident first and then your Nevada state return so that your state return can be calculated correctly against any credit from the non-resident CA state return.

Pros And Cons Of Moving To Nevada From California

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Retirement Retirement Locations

Pros And Cons Of Moving To Nevada From California

Moving Avoids California Tax Not So Fast

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Does California Tax Income Earned In Other States

Moving To Nevada From California Retirebetternow Com

Pros And Cons Of Moving To Nevada From California

What A National 15 Minimum Wage Actually Means In Your State Mark J Perry Map States Cost Of Living

Nevada The New California The Nevada Independent

Is California Pension Income Taxable Outside California

Nevada Sales Tax Small Business Guide Truic

Nevada Vs California Taxes Retirepedia

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map