does texas have inheritance tax 2021

There is a 40 percent federal tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

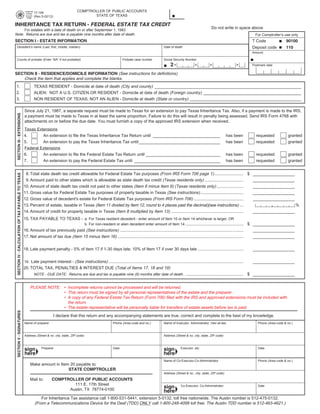

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

However in Texas there is.

. The short answer is no. Elimination of estate taxes and returns. Inheritance Tax Laws in Texas.

Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. However other stipulations might mean youll still get taxed on an inheritance. Or have Inheritance and Estate Tax forms mailed to you contact the Inheritance and Estate Tax.

Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. Inheritance tax also called the estate tax or death tax is levied at both the federal level and state level and applies to any assets transferred to. The good news is that texas doesnt impose an estate or inheritance tax.

There is no inheritance tax in Texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. However if a loved one who lives in another state leaves you money you may be subject to inheritance taxes in.

Twelve states and washington dc. The state of Texas does not have any inheritance of estate taxes. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

There is a 40 percent federal tax however on estates over. There is a 40. Fortunately Texas Is One Of The 33 States That Does Not Have.

Before breathing too big a sigh of relief Texan beneficiaries need to be aware that although Texas has no inheritance tax assets may still be subject to state inheritance taxes. The top estate tax rate is 16 percent. Texas does not have an inheritance tax.

Gift Taxes In Texas. However this is only levied against estates worth more than 117 million. There is a 40 percent federal tax however on estates over.

For 2020 and 2021 the top estate-tax rate is 40. There are not any estate or inheritance taxes in the state of Texas. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. For 2021 the IRS estate tax exemption is 117. The state of Texas does not have any inheritance of estate taxes.

As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117. Inheritance Tax In Texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

When someone dies their estate goes through a legal process known as probate. Inheritance taxes in Texas. Although some states have state estate inheritance or death taxes at a lower threshold Texas follows the federal estate tax limits the amount you can leave to your heirs.

Estate Tax In The United States Wikipedia

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

How Is An Inheritance Treated In A Texas Divorce

What Is The Proposed Biden Death Tax The Us Sun

Biden S New Death Tax Hits The Middle Class While Excluding Certain Wealthy Investors

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Death And Taxes Nebraska S Inheritance Tax

What Are Inheritance Taxes Turbotax Tax Tips Videos

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Not All Property Tax Deductions Are Limited Sol Schwartz

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate And Inheritance Taxes Urban Institute

Talking Taxes An Educational Discussion Of The Estate Tax The Gift Tax And The Capital Gains Tax By A Texas A M Expert

Texas Estate Tax Everything You Need To Know Smartasset

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center